Economic cycles shape the landscape of markets and personal finances. By mastering their patterns, investors can ride waves of opportunity and guard against downturns.

This comprehensive guide explores each cycle phase, highlights actionable strategies, and offers insights for building resilient wealth portfolios.

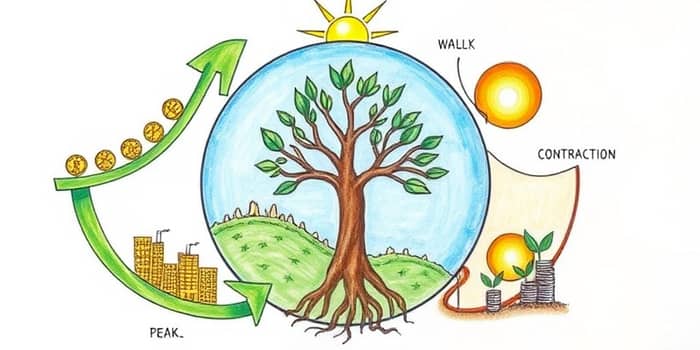

Economic cycles, or business cycles, are the natural fluctuations in economic activity over time that economies experience. They consist of four main stages: expansion, peak, contraction, and trough (or recovery).

On average, a U.S. cycle lasts about five years, though durations can vary based on global events, policy decisions, and market sentiment.

Each phase carries distinct signals. Recognizing these patterns empowers you to time investments more effectively, avoid pitfalls, and capitalize on emerging trends.

Smart investors adapt their approaches based on the current phase. Rather than chasing quick wins, they focus on enduring principles.

During expansion, consider tilting toward growth assets while hedging with quality bonds. As a peak approaches, gradually take profits and increase cash reserves. In contraction, emphasize stable income generators like investments at lower valuations and high-quality dividend stocks. Finally, in recovery, deploy reserved capital to capture rebounds in equities and real estate.

Adopting a focus on long-term wealth creation mindset reduces emotional decision-making. Regularly rebalancing your portfolio ensures you never get overly exposed to one sector or market sentiment.

Economic expansions tend to narrow the gap between high- and low-income households as job growth and wage gains spread. Conversely, contractions often exacerbate inequality when layoffs hit vulnerable sectors hardest.

Investors with capital during downturns can secure stakes in high-potential sectors at discounted prices, while those without reserves may miss out. Recognizing this dynamic is key to manage risks during market downturns and positioning for future gains.

The global economy today faces unique challenges: shifting interest rates, persistent inflation, and evolving trade policies. Geopolitical tensions and technological disruptions add layers of complexity.

Staying informed on these factors helps you adjust investment strategies accordingly. For instance, rising rates may curb real estate gains but benefit high-yield savings and certain bond segments. Meanwhile, inflation can erode fixed-income returns but bolster commodity-linked investments.

By blending macroeconomic awareness with portfolio discipline, you can navigate volatility and prepare for the next expansion phase.

Understanding economic cycles is a foundational skill for any investor seeking building resilient wealth portfolios. Each phase presents unique risks and rewards, from exuberant expansions to cautious recoveries.

By recognizing cycle signals, maintaining a diversified approach, and preserving liquidity, you create the flexibility to capitalize on market swings. Embrace a long-term perspective, rebalance consistently, and remain vigilant about global trends.

Ultimately, economic cycles are not hurdles but pathways. With knowledge, discipline, and strategic positioning, you can harness these rhythmic shifts to drive smarter, sustainable wealth growth.

References