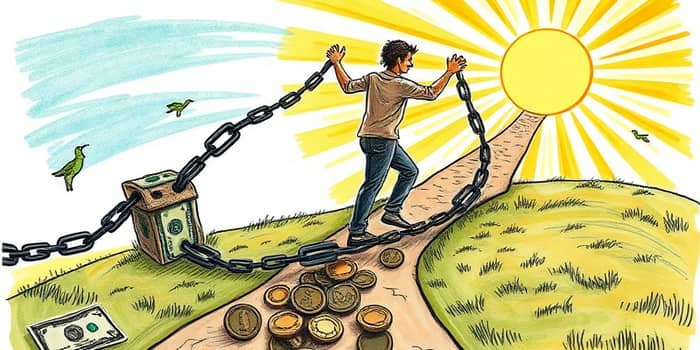

Debt can feel overwhelming, silently dictating your choices and clouding your vision of the future. Yet, with a structured approach, it is possible to reclaim control, restore peace of mind, and lay the foundation for lasting financial health.

This comprehensive guide will walk you through a clear roadmap to assess, conquer, and ultimately detoxify your debt, integrating effective strategies into your broader financial plan.

Debt is a common part of adult life, from student loans and mortgages to credit cards and personal financing. However, effective debt management is essential to keep stress at bay, maintain stability, and work toward your long-term ambitions.

By creating a strong financial plan that includes debt reduction, you can prioritize debt repayment, cover living expenses, and continue saving for future milestones such as retirement or a home purchase.

The first step in any debt detox is gaining clarity. Without a detailed overview, you cannot set priorities or measure progress. This process starts with a full inventory of your obligations.

With these details in hand, you will see the overall debt load and repayment obligations laid out before you, empowering you to choose the most effective debt reduction plan.

Budgeting is the cornerstone of debt reduction. No debt strategy can succeed without knowing exactly where your money goes each month.

Track every dollar of income and categorize your spending to identify areas for cuts. Even small savings—like brewing coffee at home or pausing unused services—can add up. Redirect these savings toward higher debt payments to accelerate your payoff timeline.

Once you have assessed your debts and set up a budget, choose a strategy that aligns with your personality and financial goals. Below is a comparison of four popular approaches.

For example, with the snowball method, list debts from smallest to largest. Pay minimums on all but apply any extra funds to the smallest debt until it’s cleared. Then roll that payment amount into the next one, building unstoppable momentum.

Examining daily habits can unlock hidden savings. That daily latte, monthly streaming service, or impulse purchase can slow your progress. By trimming even modest sums, you begin to reduce both principal and future interest faster.

Consider side hustles or selling unused items to generate extra income. Every additional dollar goes directly toward your goal, shortening the time until release from debt.

Maintaining a small safety net protects you from falling back into debt when unexpected costs arise. Aim for a starter emergency fund ($500–$1,000) to cover minor repairs, medical bills, or sudden travel expenses.

This reserve discourages reliance on high-interest credit and keeps your repayment plan on track even during surprises.

If you struggle to keep up, reach out proactively to lenders. Many will agree to lower interest rates, payment plans, or temporary forbearance when you explain your situation honestly.

Always document any new terms in writing before adjusting your payments. This ensures you have clear records and can avoid unexpected fees or miscommunications.

Not all debt is equal. Mortgages and student loans can be considered an investment in your future if they lead to asset growth or increased earnings. Conversely, high-interest credit cards and unsecured personal loans often work against your financial health.

Identify which obligations serve a long-term purpose and which should be prioritized for rapid payoff to minimize cost and risk.

Staying motivated is as important as any strategy. Cultivate a mindful, proactive attitude by reviewing your budget weekly, celebrating small victories, and adjusting goals when life changes occur.

Avoid new debt except in unavoidable circumstances, and remember that progress—no matter how slow—is still forward momentum toward freedom.

While debt relief companies promise quick fixes, not all services are reputable. Proceed with caution and watch for high fees or predatory contracts.

Know your rights under consumer protection laws. If a debt collector contacts you, request validation of the debt in writing before making any payments. This safeguard protects against errors or fraudulent claims.

Understanding your legal position empowers you to handle collection attempts confidently and fairly.

Track your payoff journey by updating your debt balances, expense patterns, and net worth regularly. Visual tools like charts or payoff calendars can reinforce motivation by showing tangible progress.

Revisit your financial plan at key milestones—such as when a debt is fully paid or after a significant life event—to ensure your strategy remains aligned with evolving goals.

By following these steps, you transform anxiety into action, stress into strategy, and debt into a tangible target you can conquer. The path to financial freedom begins with a single decision to detox your debt and integrate it into a holistic plan for a brighter tomorrow.

References